Japanese credit cards are extremely convenient in Japan for online shopping, booking airline tickets (in yen), and even spending your precious money while traveling abroad. They can even earn you some cash rewards and other goodies. But, there’s a catch… You’ll need to prove your worthiness first to a CC company.

- Why get a Japanese credit card?

- Why can’t I get a Japanese credit card?

- How does credit card billing work?

- How do installment payments work?

- Treat it as a debit card

- Building credit

- Applying for a Japanese credit card

- Where to apply?

- What to bring when applying?

- When will you receive your credit card?

Why get a Japanese Credit Card?

- “Debit Card” – it works like a debit card for one-time payment transactions.

- Online Shopping – you won’t need to pay at the conbini or with your home country’s card when shopping online.

- In-store Shopping – you won’t need to carry around a giant wad of cash for big in-store purchases.

- Airline Tickets – you can shop for plane tickets in yen; yes, it can be cheaper!

- Highway Tolls – you can get a CC with ETC (Electronic Toll Collection System) function, which can save you highway toll fees.

- IC Card for Transit – CC can have IC (Suica, Pasmo, ICOCA, etc.) functionality for trains, buses, and the Shinkansen.

- Shopping Abroad – a Japanese VISA or Mastercard will work overseas and can save you time and money without the need to exchange yen.

- Points and Rewards – you can score points and rewards from a variety of different CC.

- Installment Payments – say you want to buy an expensive TV, well you can make monthly payments or “ribo barai” or “revolving payment.”

- Japanese Cheap Phone Plans – mobile virtual network operators (MVNOs) like Sakura Mobile, Line, and AEON Mobile only accept CC for monthly payments.

- Building Credit – it’s the only easy way to build credit in Japan that I am aware of.

Why can’t I get a Japanese Credit Card?

- Your Visa is short-term. No card company will consider you if you have a 6-month or visitor’s visa!

- You haven’t been in Japan long enough. Don’t expect a credit card offer after being in Japan for a month, try after six months to a year.

- You don’t have a Japanese bank account and/or inkan/personal seal, proof of address, or utility bill. These are mandatory during the application process. You should definitely know your BOE’s address and your income level when applying

- Your income is too low. Being employed part-time or as a low-salary worker might disqualify you.

- Your bank account is low on funds. You should have a decent amount of money before applying – around 1 million yen.

How does CC billing work?

Typically, in most western countries you pay as you go. You pay when your statement is due and enjoy the reoccurring high-interest rates if not paid off. But, Japan is slightly different!

In Japan, you pay your statement in full at the beginning or the end of every month. That’s determined by the CC company when it’s due. From my experience, it was taken out at the end of every month or the beginning sometimes.

How do installment payments work such as bunkastsu barai, ribo barai, and kyashingu?

Before you pay for a purchase with a Japanese credit card, you have the option to split your purchase into multi payments called, “bunkatsu barai.” This happens at the point of sale where you’ll be asked by the cashier how many times you want to pay.

For example: “Is one-time payment alright?” (Oshiharai ha ikkatsu de yoroshii desyouka?)

Typically, you will say “ikkai” or “one time” which means your transaction will come out of your bank account as one lump sum during your billing cycle. If you say “sankai” or “three times”, then your original purchase amount will be split into 3 payments over the next three months with interest.

If you buy a 30,000 yen microwave, it’ll be 10,000 yen a month, plus interest (about 15%). Honestly, I never tried this method for purchase because I didn’t understand the system well enough. But CC companies offer bonus points or cash perks for using it.

Here is an example of a usage scenario of paying 100,000 yen over 10, 14, 20 or 50 times回

S-course takes 50 months (4.1 years!) with 31,570 paid in interest. Not at all bad compared with American interest rates

As a foreigner, if you have limited Japanese ability, I would recommend not using “bunkatsu barai” or “Ribo Barai” (リボ払い), short for revolving payments.

Ribo Barai is similar to the Western system of pay-as-you-go (lay-away) where the balance for each month is divided and includes a finance fee. This option only works in Japan.

Both bunkatsu barai and ribo barai are similar with the exception of Kyashingu (キャッシング), cash from an ATM.

Kyashingu comes with a high-interest rate between 8%-18% if you withdraw money from an ATM. There are also limits on the amount of cash you can withdraw that is based on your CC limits. Cashing comes in handy if you are overseas in a country where only cash is accepted.

Treat it as a debit card

I always used my CC as a debit card. Whenever I bought something with it, I knew it would be withdrawn automatically at the end of the month from my bank account. It was nice knowing that I didn’t need to worry about paying it off and that it had no interest for one-time payments.

The most important thing is to make sure your bank account always has enough money to pay off the credit card after one-time purchases. If you don’t, then you will be charged interest. It’s very easy to avoid as long as it’s linked to your biggest bank account for large purchases.

Building credit with a Japanese credit card

Japanese CC companies will start you off with a low credit limit. I believe it is based on your salary, the amount of savings you have, and how long you’ve stayed in Japan.

I was given a credit limit of 300,000 yen to start while my significant other was only given 70,000 yen. I was in Japan longer than them, so I had more money in my savings account when I applied.

Credit limits increase over time based on the number of expenditures, timely payments, and the amount of money you have. I used to buy lots of goods off Amazon… as well as international flights for going home and abroad.

By my 3rd year, my credit limit was maxed at 1,000,000 yen. Yes, that’s incredibly high for a short-term teacher. My card let me adjust the amount online. I believe this was for fraud prevention.

Applying for a Japanese Credit Card

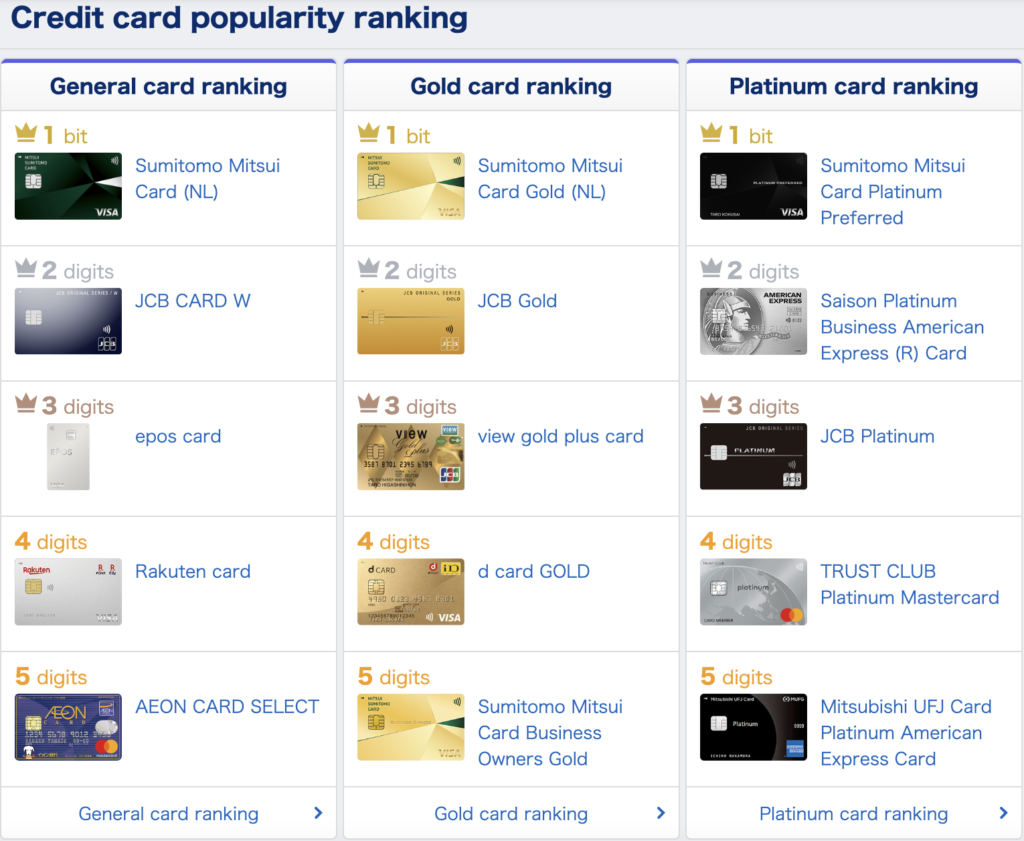

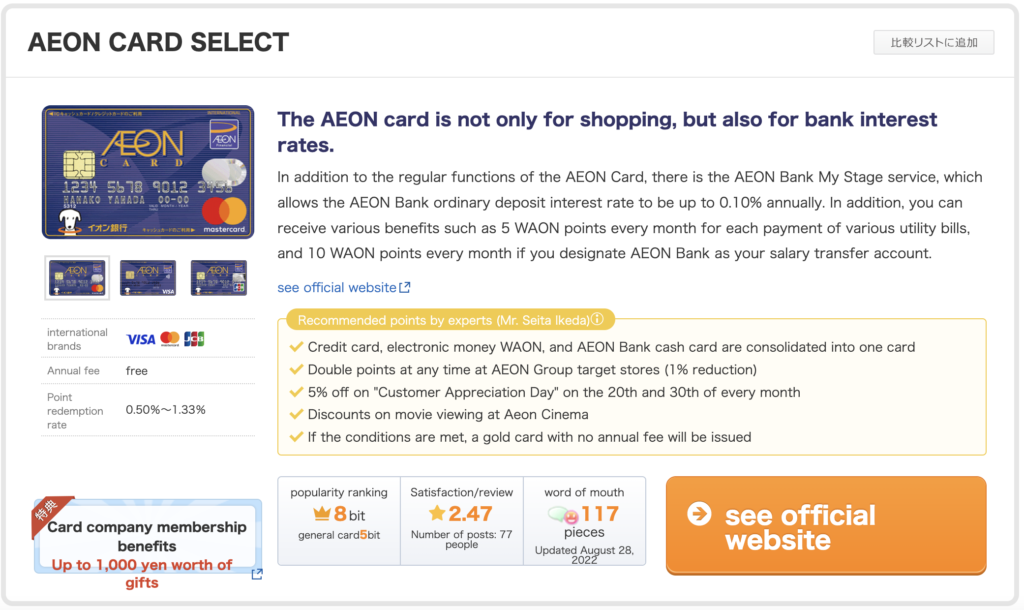

Before applying, research the type of CC you want. Kakaku.com has an entire section, only in Japanese, about the hundreds of CC available in Japan. You can learn about the points, rewards, user experience, where to apply, and just about anything else related to the card you are interested in. Use Google translate to navigate and learn about CCs.

Consider all the features of the CC and especially if there is an annual fee or not. You may want to avoid those types of cards, but the rewards are better. Also, think about the type. I recommend VISA or Mastercard as you can use them abroad unlike JCB.

Where to apply?

I always recommend applying in person for a CC. You can find many places offering CC at department stores, malls, airports, grocery stores, and even train stations. I recommend this method because a CC representative will guide you through the paperwork. It is unlikely that the rep will deny you from applying.

Reps are always extremely nice. They know the process well and it’s their job to help you receive one. They only care about money and not whether you are a foreigner or local.

What to bring when applying in person?

- Alien registration (外国人登録, gaikokujin tōroku) card

- Bank book where you receive your monthly salary.

- Company information (name, location, contact information) and salary information (how much you are paid yearly)

- Passport just in case

- Translator if your Japanese isn’t good. Honestly, you can get by with only saying, “hai” and knowing how to write your address.

You won’t need a lot of special documents. The first three are the most important!

When will you receive your Japanese credit card?

You will receive a letter in the mail that you were approved or denied along with the CC itself. If you never hear back, assume you were denied. There isn’t much you can do but look for another CC you want! Don’t be disappointed if you don’t get a card the first time. It happens.

From my experience, I was approved the first time, but only because I was in Japan for a while with a lot of money saved up. I knew plenty of people who never got a card the first time or were always denied. Just remember you have no credit history in Japan!